开山资讯|国际知名刊物介绍开山地热井口模块电站技术及其成就

日前,国际电力行业知名刊物《Power》刊登题为“模块化发电厂正在提高肯尼亚地热效率”的文章,向全球介绍我集团首创的地热井口电站技术及其成就。这是继新华社、《人民日报》等中国央媒介绍开山在肯尼亚取得的成就之后,又一个国际级媒体的推介。

《Power Magazine》在全球电力行业具有显著的影响力。作为全球最古老的能源行业期刊之一,自1882年创刊以来,已成为电力行业内的重要信息来源和行业标准。其影响力既源于权威性和历史性,还因为其拥有广泛的受众群体,读者涵盖了全球电力行业专业人士,包括电力工程师、运营经理、技术专家、决策者和企业高管,它通过提供深入的技术分析、案例研究和行业新闻,帮助专业人士做出更好的决策和理解行业动态。《Power Magazine》在全球电力行业扮演重要的角色,既是信息传播的重要渠道,也是行业趋势和技术发展的风向标,该刊物宣介开山地热井口模块电站技术标志着我集团拥有自主知识产权的核心技术得到业内主流媒体的认同,也料将极大地推动开山技术在全球的应用。

下面是本编辑部转发的新闻和转载文章的中英文对照文本,以飨读者。

A Modular Power Plant Is Steaming Up Kenya's Geothermal Efficiency

Sosian Menegai during the commissioning phase. Courtesy: Kaishan Group

Sosian Menengai Geothermal Power, Kenya’s newest geothermal power plant, is powered by modular technology that maximizes efficiency, reduces costs, and enhances scalability.

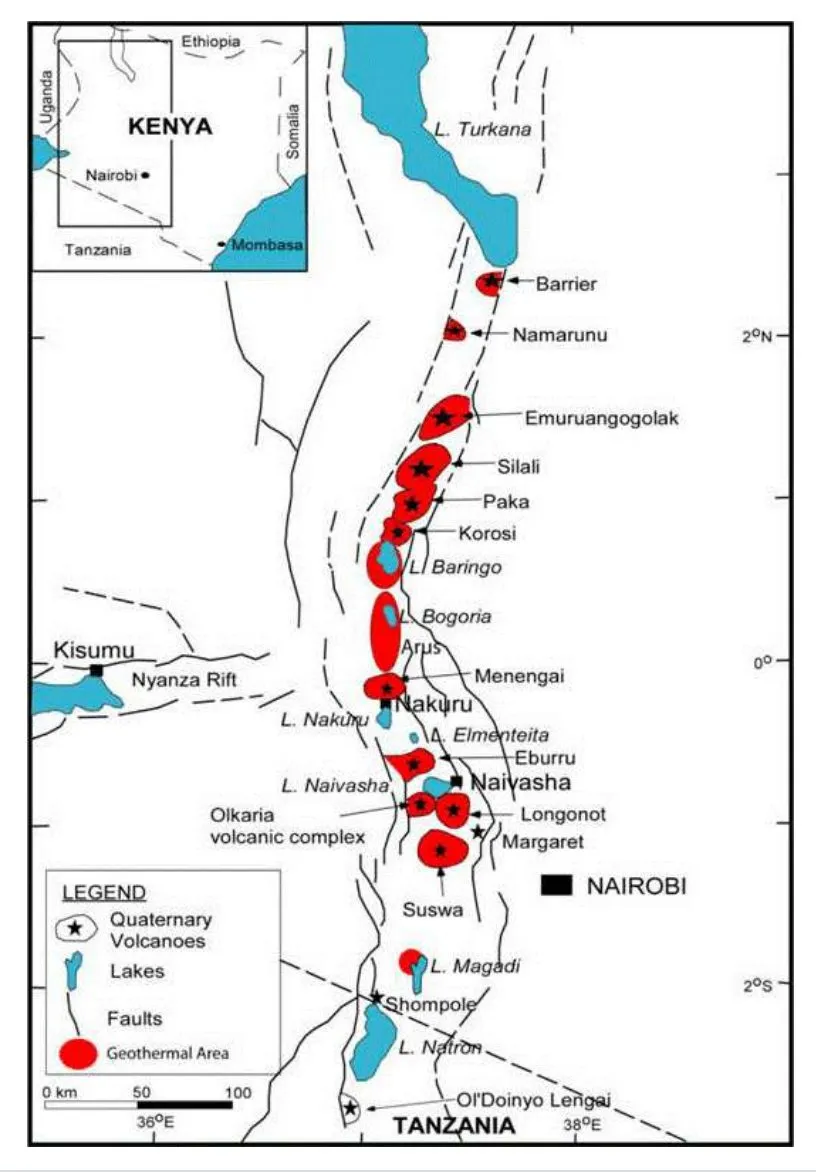

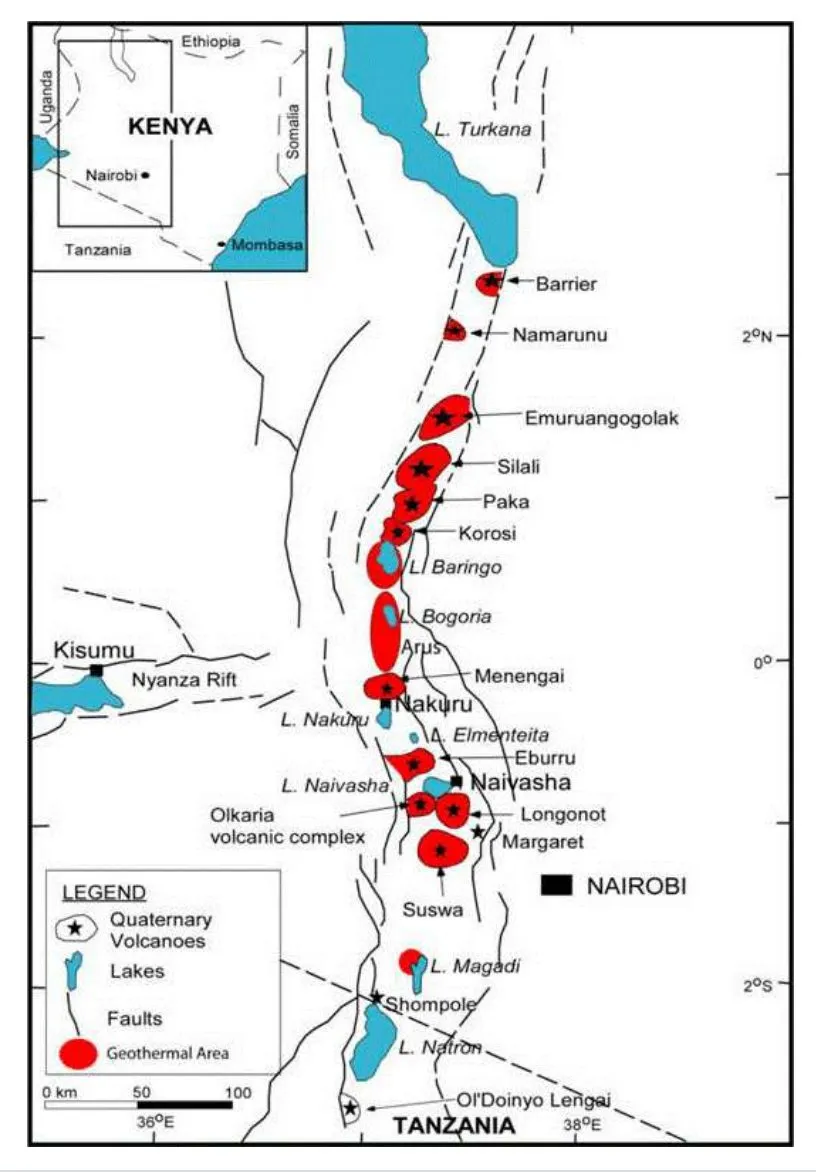

Kenya’s scenic Rift Valley region is a literal hotbed of geothermal potential. Part of the vast East African Rift Valley System (EARS), a 6.400-kilometer (km) tectonic divergence that is cleaving the African continent into two plates, Kenya’s Rift Valley forms a vertical corridor of intensive faulting and volcanic activity, hot springs, fumaroles, and sulfur-oozing fissures. But while the country began geothermal exploration for power development in the 1950s, most of its investments have been focused on the Olkaria region situated within Hell’s Gate National Park near the flamingo-flecked Lake Naivasha in Nakuru County. Five of six geothermal power stations in Olkaria are owned by KenGen (with a combined capacity of 799 MW), while Nevada-based Ormat Technologies owns a 150-MW plant. Olkaria plants in 2023 provided nearly 45% of Kenya’s total generation, a sizeable contribution to the East African powerhouse’s meager 3.3-GW installed capacity.

In 2008. the Geothermal Development Co. (GDC), a state-owned special-purpose vehicle tasked with accelerating the nation’s geothermal resource development, expanded its focus to the Menengai region just north of Olkaria, at the site of a massive shield volcano with one of the biggest calderas in the world. While GDC says the Menengai complex harbors a potential of 1.600 MW, its long-term goal is to develop 465 MW of geothermal steam equivalent.

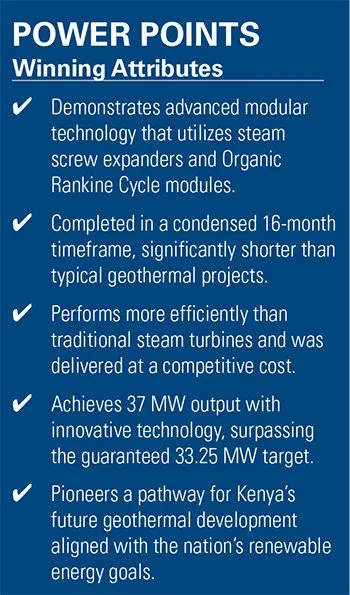

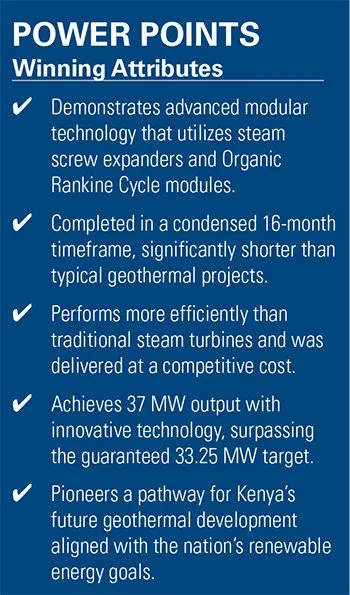

In 2013. it took the first step to competitively award the first three initial 35-MW power projects at the complex to three independent power producers (IPPs): Orpower 22 (a former subsidiary of New York firm Symbion now owned by China’s Kaishan Group), South African-based Quantum Power East Africa (now majority owned by UK firm Globeleq), and Nairobi-headquartered Sosian Energy. In August 2023. the first of these projects—Menengai III, now formally known as the Sosian Menengai Geothermal Power—wrapped up a 16-month construction timeframe and began delivering first power to the grid.

Map showing location of geothermal area along the Kenyan Rift Valley. Courtesy: KenGen

A Technology Breakthrough

Sosian’s condensed timeframe is especially stunning given that traditional geothermal development can exceed seven years. This is owing in part to a complex process that involves drilling and testing multiple wells, selecting a centralized power plant location, ordering steam turbines, and constructing extensive steam collection and reinjection systems. The traditional approach is also ridden with risks, including significant delays and inefficiencies, such as energy losses from steam pressure drops, thermal losses over long distances, and the underutilization of wells with varying pressures.

Sosian, to some measure, had the benefit of the GDC’s public-private partnership model for developing Menengai, under which the GDC assumes upfront risks of geothermal development. The state company has also notably set out to develop the field in five phases, starting with a 105-MW “steam sales” model, where it supplies steam from drilled wells to the power plants via a 25-km steam gathering and piping system. As of 2023. GDC had drilled 53 wells with a potential of 169 MW.

However, the power plant’s success can also be attributed to a distinctive new geothermal development process introduced by China’s Kaishan Group. Dr. Tang Yan, general manager of Kaishan Group, recalled realizing the need for a dramatic shift at a 2015 geothermal conference in Melbourne, Australia, where experts discussed the pitfalls of conventional methods. “I said, ‘Why don’t you put a power plant on the wellhead and do it phase by phase?’ ” he recounted.

Overcoming Traditional Challenges

While the approach proposed to support incremental power production from the start while providing revenue to support future project expansion, Yan learned no technology to support the approach was commercially available. Kaishan, which had then already begun its transition from a giant Shanghai-headquartered air compressor maker to a diversified global company, jumped into action to leverage its 2012-developed Organic Rankine Cycle (ORC) expander and screw steam expander technologies.

The technologies—originally developed for waste heat recovery from refineries and steel mills—allowed Kaishan to optimize geothermal power generation by maximizing energy output from varying well conditions, reducing inefficiencies, and enabling the development of four types of decentralized, modular power plants that are quicker to deploy and more adaptable to different geothermal fields, Yan told POWER. “These modular power plants include the steam screw expander modular power plants, the steam ORC modular power plants, the brine ORC modular power plants, and the steam and brine dual resource modular power plants,” he explained.

Steam screw expanders are specifically designed to handle wet or saturated steam, which is common in geothermal wells, effectively extracting energy from a wider range of well conditions, including wells with high non-condensable gas (NCG) content that may not be suitable for traditional turbines. ORC systems, meanwhile, are adept at converting lower-temperature steam and brine—byproducts that would otherwise go to waste—into additional electricity, Yan said.

In addition, Kaishan’s modular plants can be used to form hybrid cycles or thermal systems to meet any production well conditions, maximize their power output, and eliminate low-head pressure (WHP) wasted wells or idling wells. Because the technologies can be adapted to specific geothermal resource conditions at different project sites, they can be tailored to provide stellar efficiency, he said. “We can improve the well thermal efficiency of, for example, medium enthalpy wells, to up to 18% and 19%,” he said. That compares to only 8% to 12% for traditional centralized power plants that only use single-flash steam, he noted.

The 35-MWe Sosian Menengai Geothermal Power plant was commissioned in August 2023. The plant uses two Kaishan geothermal steam counterpressure screw expanders, which discharge their exhausts into three Organic Rankine Cycle units. Courtesy: Kaishan Group

A Competitive Edge for New Geothermal Power

Kaishan quickly expanded the niche technology into a lucrative business. Since it put online the first of four phases of the 240-MW Sorik Marapi Geothermal Project in Indonesia in 2018. it has built the 10-MW Sokoria Geothermal, also in Indonesia, alongside projects in Turkey, the U.S., and Hungary. At Sosian, Kaishan’s first project in Kenya, the company served as the engineering, procurement, and construction (EPC) contractor.

According to Yan, Kaishan’s cost-effective price point proved a crucial selection advantage. Kaishan’s EPC contract is valued at $65 million, compared to a $108 million EPC contract recently awarded for Menengai II, one of the region’s three equally sized IPP projects. The price difference is rooted in the technology selection, Yan explained. While Sosian’s 35-MW project was designed as a centralized power plant, it is powered by two steam screw expanders and three wet steam ORC modular power plants.

However, GDC’s steam contains 3.3% NCG—which represents a “huge percentage,” he said. If Sosian used traditional steam turbines, they would need to expand steam at 6 bar absolute and then consume more then 30 tons of steam per hour to remove NCG using steam injectors and vacuum pumps. Instead, Sosian employs steam screw expanders and a bottom cycle to handle the saturated steam discharge, reducing the steam to atmospheric levels throughout the entire process while eliminating the parasitic power typically consumed by vacuum systems.

“The overall efficiency compared to a traditional steam turbine is a huge game changer for this site,” Yan said. “The project only needed a guarantee of 33.25 MW, and the target was 35 MW, but we’re actually generating 37 MW.” At the same time, the project doesn’t need to purchase the extra 10% of steam for a steam injector, putting less of a burden on the GDC, he said.

A Solution for Idled Wells

The modularity of the system also proved beneficial to speed up construction and, crucially, to overcome supply chain and project management challenges posed by the COVID pandemic, Yan said. Kaishan typically assembles the modules and conducts component testing in a factory setting over six to nine months, he said. “And then, when we ship to the site, usually it takes a very short time to put them together, and you don’t need to do any welding on the power modules,” he added. “That’s sometimes where quality control can be a challenge,” he noted.

The success of the Sosian Menegai project has so far sparked significant interest in Kenya’s geothermal industry, Yan said. A key reason is that Kenya has a lot of wells, and an estimated 25% to 30% of those wells may not be supported by a steam collection system, which is needed by centralized steam turbines. “They call them idled wells or wasted wells, and they sit there and do nothing,” even if it was costly to drill them, he said. “But our technology doesn’t have that limitation because we can use any good pressure, whether they can produce brine or steam.”

—Sonal Patel is a POWER senior editor

中文翻译稿

模块化发电厂正在提高肯尼亚地热效率

调试阶段的 Sosian Menegai。图片来源:开山集团

肯尼亚最新的地热发电厂 Sosian Menengai

肯尼亚风景秀丽的裂谷地区是地热资源的宝库。肯尼亚裂谷是广阔的东非大裂谷系统 (EARS) 的一部分,东非大裂谷系统是一个长达 6.400 公里的地质构造分叉,将非洲大陆一分为二。肯尼亚裂谷形成了一个垂直走廊,其中有密集的断层和火山活动、温泉、喷气孔和硫磺渗出的裂缝。尽管肯尼亚在 20 世纪 50 年代就开始进行地热勘探以开发电力,但其大部分投资都集中在位于地狱之门国家公园内的奥尔卡里亚地区,该公园靠近纳库鲁县火烈鸟点缀的纳瓦沙湖。奥尔卡里亚的六座地热发电站中有五座归 KenGen 所有(总容量为 799 兆瓦),而总部位于内华达州的 Ormat Technologies拥有一座 150 兆瓦的发电站。到 2023 年,奥尔卡里亚 (Olkaria) 电厂将提供肯尼亚近 45% 的总发电量,为这个东非强国仅有的 3.3 吉瓦的装机容量做出了巨大贡献。

2008 年,地热开发公司 (GDC) 将重点扩大到奥尔卡里亚以北的梅嫩盖地区,该地区是一座巨大的盾形火山,拥有世界上最大的火山口之一。地热开发公司是一家国有特殊目的公司,其任务是加速该国的地热资源开发。GDC 表示,梅嫩盖综合体蕴藏着 1.600 兆瓦的地热潜力,但其长期目标是开发 465 兆瓦的地热蒸汽当量。

2013 年,该集团迈出了第一步,通过竞争方式将该综合体中的前三个 35 兆瓦发电项目授予三家独立电力供应商 (IPP):Orpower 22(前身为纽约 Symbion 公司的子公司,现归中国开山集团所有)、总部位于南非的 Quantum Power East Africa(现由英国公司 Globeleq 控股)和总部位于内罗毕的 Sosian Energy。2023 年 8 月,这些项目中的第一个项目——Menengai III(现正式称为 Sosian Menengai 地热发电项目)结束了为期 16 个月的建设工期,并开始向电网输送第一批电力。

地图显示了肯尼亚裂谷沿线地热区的位置。图片来源:KenGen

技术突破

鉴于传统地热开发可能要耗时超过七年,Sosian 的缩短工期尤其令人震惊。这在一定程度上归因于一个复杂的过程,包括钻探和测试多个井、选择集中发电厂位置、订购蒸汽涡轮机以及建造广泛的蒸汽收集和再注入系统。传统方法也充满风险,包括严重的延误和效率低下,例如蒸汽压力下降造成的能量损失、长距离热损失以及压力变化的井的利用不足。

在某种程度上,Sosian 受益于 GDC 开发 Menengai 的公私合作模式,根据该模式,GDC 承担地热开发的前期风险。值得注意的是,这家国有公司还计划分五个阶段开发该地热田,首先采用 105 兆瓦的“蒸汽销售”模式,通过 25 公里长的蒸汽收集和管道系统将钻井中的蒸汽供应给发电厂。截至 2023 年,GDC 已钻探了 53 口井,潜力为 169 兆瓦。

然而,该发电厂的成功也归功于中国开山集团推出的独特的新型地热开发工艺。开山集团总经理汤炎博士回忆说,他在 2015 年澳大利亚墨尔本举行的地热会议上意识到需要进行重大转变,当时专家们讨论了传统方法的缺陷。“我说,‘你为什么不在井口建一个发电厂,分阶段进行呢?’”他回忆道。

克服传统挑战

虽然该方法从一开始就提出支持增量发电,同时提供收入以支持未来的项目扩展,但汤炎博士了解到,没有支持该方法的技术可供商业使用。开山当时已经开始从一家总部位于上海的大型空气压缩机制造商转型为一家多元化的全球性公司,并立即采取行动,利用其 2012 年开发的有机朗肯循环 (ORC) 膨胀机和螺杆蒸汽膨胀机技术。

汤炎博士告诉《POWER》杂志,这些技术最初是为回收炼油厂和钢厂的废热而开发的,它使开山公司能够通过最大限度地提高不同井况下的能量输出、减少低效率,以及开发四种类型的分散式模块化发电厂来优化地热发电,这些发电厂部署速度更快,更能适应不同的地热田。 “这些模块化发电厂包括蒸汽螺杆膨胀机模块化发电厂、蒸汽 ORC 模块化发电厂、盐水 ORC 模块化发电厂以及蒸汽和盐水双资源模块化发电厂,”他解释说。

蒸汽螺杆膨胀机专门设计用于处理地热井中常见的湿蒸汽或饱和蒸汽,可有效从各种井况中提取能量,包括可能不适合传统涡轮机的不凝性气体 (NCG)含量高的井。与此同时,ORC 系统擅长将低温蒸汽和盐水(否则这些副产品将被浪费)转化为额外的电能,汤炎博士说。

此外,开山的模块化电厂可用于形成混合循环或热力系统,以满足任何生产井条件,最大限度地提高其发电量,并消除低压 (WHP) 浪费井或闲置井。他说,由于这些技术可以适应不同项目地点的特定地热资源条件,因此可以量身定制以提供卓越的效率。他说:“我们可以将中焓井的热效率提高到 18% 和 19%。”他指出,相比之下,仅使用单次闪蒸蒸汽的传统集中式发电厂的热效率仅为 8% 至 12%。

35 MWe 的 Sosian Menengai 地热发电厂于 2023 年 8 月投入使用。该电厂使用两台开山地热蒸汽反压螺杆膨胀机,将废气排放到三个有机朗肯循环装置中。图片来源:开山集团

新地热发电的竞争优势

开山迅速将这项小众技术拓展为一项利润丰厚的业务。自2018 年在印度尼西亚投产 240 兆瓦 Sorik Marapi 地热项目四期工程中的第一期以来,该公司已在印度尼西亚建造了 10 兆瓦的 Sokoria 地热项目,此外还在土耳其、美国和匈牙利开展了项目。Sosian是开山在肯尼亚的第一个地热项目,公司担任工程、采购和施工 (EPC) 承包商。

汤炎博士表示,开山电厂具有成本效益的价格点是其关键的选择优势。开山电厂的 EPC 合同价值 6500 万美元,而该地区三个同等规模的 IPP 项目之一 Menengai II 最近获得的 EPC 合同价值 1.08 亿美元。汤炎博士解释说,价格差异的根源在于技术选择。虽然 Sosian 的 35 兆瓦项目设计为集中式发电厂,但它由两个蒸汽螺杆膨胀机和三个湿蒸汽 ORC 模块化发电厂提供动力。

然而,GDC 的蒸汽含有 3.3% 的 NCG,这是一个“巨大的百分比”,他说。如果 Sosian 使用传统的蒸汽轮机,他们需要将蒸汽膨胀至 6 bar 绝对压力,然后每小时消耗超过 30 吨的蒸汽,使用蒸汽喷射器和真空泵去除 NCG。相反,Sosian 使用蒸汽螺杆膨胀机和底部循环来处理饱和蒸汽排放,在整个过程中将蒸汽降低到大气水平,同时消除真空系统通常消耗的寄生功率。

“与传统蒸汽轮机相比,整体效率对于该站点来说是一个巨大的改变,”汤炎博士说道。“该项目只需要保证 33.25 兆瓦,目标是 35 兆瓦,但我们实际上发电量为 37 兆瓦。”同时,该项目不需要额外购买10%的蒸汽用于蒸汽喷射器,从而减轻了GDC的负担,他说。

闲置地热井的解决方案

汤炎博士表示,该系统的模块化设计也有利于加快施工速度,更重要的是,有助于克服新冠疫情带来的供应链和项目管理挑战。他说,开山通常会在六到九个月的时间内组装模块并在工厂环境中进行组件测试。“然后,当我们运送到现场时,通常只需很短的时间即可将它们组装在一起,并且您无需对电源模块进行任何焊接,”他补充道。“有时,质量控制可能是一个挑战,”他指出。

他还说,Sosian Menegai 项目的成功迄今已引起人们对肯尼亚地热产业的极大兴趣。一个关键原因是肯尼亚有很多井,估计其中 25% 到 30% 的井可能没有蒸汽收集系统,而蒸汽收集系统是集中式蒸汽涡轮机所必需的。“他们称这些井为闲置井或废弃井,它们就放在那里,什么也不做”,即使钻探这些井的成本很高,“但我们的技术没有这种限制,因为我们可以使用任何良好的压力,无论它们是产生盐水还是蒸汽。”

— Sonal Patel 是 POWER 的高级编辑(@sonalcpatel, @POWERmagazine)

关注我们

关注我们